Dispatch №18

Family Offices and Wealth Shifts. Aussie Market Outperforms. Longevity Lifestyle Keys. AI's Future Impact. Wealthy Go Crazy

Want to add 20+ years to your life AND outperform global markets? This comprehensive Dispatch, that you may call "The Fortunes of Wealth and Health," offers a multifaceted exploration of global financial trends and personal well-being. It primarily focuses on strategic shifts in family office asset allocation, revealing increased interest in developed market equities and private debt while highlighting significant regional divergences in investment approaches. Our report reveals how Australia's private capital market is yielding a median 13.8% net IRR with unmatched low risk. Discover the 8 profound lifestyle factors that could extend your lifespan by decades. Uncover why the world's savviest family offices are now pouring capital into AI and private debt. Plus, get raw, unprecedented insights into the hidden mental health battles even tycoons face. Ultimately, our Dispatch aims to provide a holistic view of the interconnectedness of wealth management, health, and personal growth, offering practical guidance for investors and individuals alike. Don't just chase wealth; master your longevity.

Main topic of the week

Global Family Office Report 2025, published in May by UBS, is an in-depth survey capturing the views of 317 family offices globally, each managing an average of USD 1.1 billion. The report delves into various critical aspects of family office management, including strategic asset allocation, risk management, the impact of emerging technologies, and professionalisation efforts. A key theme is the family offices' long-term, diversified approach to wealth preservation, with notable shifts towards developed market equities and private debt for growth and yield. The report also highlights the increasing importance of sustainability in investing and the challenges surrounding succession planning and staff recruitment, where personality and trust often outweigh formal qualifications.

This report is 80 pages long, so we will highlight the main ideas and data for you:

1. Overall strategic asset allocation remains relatively stable, but with notable shifts within asset classes. The report shows that in 2024, the allocation between traditional (56%) and alternative (44%) asset classes stayed nearly unchanged compared to 2023, when alternatives accounted for 42%. However, beneath this surface-level stability, significant changes are taking place. Family offices are reducing their cash holdings and increasing investments in developed market equities, likely aiming to tap into long-term structural growth opportunities. There's also a noticeable uptick in allocations to private credit, possibly in search of enhanced yield. Some are planning to increase allocations to developed market fixed income instruments, potentially for diversification purposes.

In 2024, the average allocation to cash or cash equivalents decreased from 10% in 2023 to 8%. Among those planning changes in 2025, a further reduction in cash holdings to 6% is expected, partially to fund planned increases in allocations to developed market equities and private credit. The average allocation to private equity declined slightly from a peak of 22% in 2023 to 21% in 2024 (11% in direct investments and 10% in funds/funds of funds), amid subdued capital market activity and high financing costs. Family offices planning adjustments in 2025 anticipate a further decrease to 18% (8% in direct investments and 10% in funds/funds of funds), though some expect an increase over the long term.

Practical Implications: Family offices can use this information to benchmark their current allocations against broader trends. The reduction in cash holdings may indicate a search for higher-yielding assets. Increased interest in private credit and developed market equities highlights investment themes that may be relevant for inclusion or expansion in portfolios aiming for growth and diversification. Understanding the reduction in private equity allocations—especially among those not engaging in direct investments—due to exit challenges, can support better liquidity risk assessment and future investment planning in this asset class.

2. Increased Focus on Developed Market Equities as a Source of Structural Growth. The average allocation of family offices to developed market equities rose from 24% in 2023 to 26% in 2024. Furthermore, among family offices planning changes in 2025, the average allocation to this asset class is expected to increase to 29%. This shift is likely driven by the pursuit of access to long-term structural growth trends. According to the UBS Chief Investment Office, three transformative innovative opportunities (TRIOs) are expected to drive equity markets over the next decade: artificial intelligence (AI), energy and resources, and longevity.

Despite market turbulence in early April 2025, family offices reaffirmed their long-term orientation, maintaining a diversified strategic allocation. Some tactically increased their positions in large U.S. companies by buying during market dips rather than selling at peaks. Others, noticing “clouds on the horizon” and high U.S. equity valuations at the end of 2024, reduced their exposure in January 2025 and remain underweight in the U.S. relative to benchmarks, favoring markets with more attractive valuations such as Europe and Japan. Some even reallocated equity holdings from the U.S. to Europe. Nonetheless, developed market equities remain the "favorite" asset class over a five-year horizon, with many expecting either significant or moderate increases in allocations (the exact proportion is not specified but is implied to be high, especially in contrast to fixed income instruments).

Practical Implications: This trend highlights the importance of including developed market equities in long-term strategy. Family offices can deepen their understanding of the “transformative innovative opportunities” (TRIOs) identified by UBS CIO and explore how to gain exposure to them through public markets. Analyzing differing regional approaches—such as the caution of European offices versus the tactical buying of American giants—can assist in shaping one’s own regional allocation and tactical decisions.

3. Growing Interest in Private Debt as a Tool for Enhancing Yield and Diversification. Average allocations to private debt doubled to 4% in 2024, up from 2% the previous year. Among family offices planning changes in 2025, this share is expected to rise further to 5%. Sources indicate that private debt can provide additional yield while also offering diversification benefits. A manager of a European family office noted that private debt is "a relatively new asset class – it's trendy, and everyone wants a piece of it to chase returns and lock in higher fixed yields." However, the same manager expressed caution, stating, "I'm still not convinced about the risk-return characteristics. Over a five-year horizon, nearly one-third (30%) of family offices expect a significant or moderate increase in allocations to private debt.

Practical Implications: The rising popularity of private debt reflects family offices' search for ways to boost returns amid persistently low interest rates (even as Fed and ECB policy may shift) and to diversify their portfolios. Family offices considering private debt should carefully assess its risks and potential returns and recognize that, while the asset class may be fashionable, it may not suit every investment profile. The growing expectations for increased allocations to private debt over the next five years suggest this asset class is likely to remain a focus going forward.

4. Significant Geographic Concentration in Asset Allocation, Particularly Among U.S. Family Offices. On average, nearly four-fifths (79%) of global family office assets are concentrated in North America and Western Europe. Notably, U.S. family offices exhibit a strong *home bias* and have, over the past five years, almost entirely withdrawn from international markets. As of early 2025 (based on survey data), U.S. family offices had 86% of their portfolios invested in North America—an increase from 74% in 2020. No other region demonstrates such a pronounced home bias.

Asset allocation also varies significantly depending on where a family office is based. For example, Latin American family offices have a higher allocation to fixed income instruments than those in other regions—31% in 2024 compared to the 18% global average. U.S. family offices increased their allocation to real estate from 10% in 2023 to 18% in 2024, while Latin American and Southeast Asian offices reduced theirs.

Despite North America's dominance in current allocations, the Asia-Pacific region (excluding Greater China) is the top destination where the largest number of family offices plan to increase investments over the next five years (35%), followed by North America (32%).

Practical Implications: The strong home bias—especially among U.S. family offices—may signal potential under-diversification across regions. A quote from a U.S. family office executive about rethinking their heavy U.S. exposure and anticipating a “turning point” highlights this concern. Family offices should evaluate their geographic allocations and consider increasing investments in other regions—particularly those where peers are planning expansion, such as the Asia-Pacific. Understanding regional asset class preferences (e.g., fixed income in Latin America, real estate in the U.S.) provides useful context for comparative analysis and strategic positioning.

5. Emerging Technologies: Healthcare, Electrification, and AI as Key Areas of Interest. Family offices are actively seeking to understand how to invest in emerging technologies. The areas where they are most likely to already have a clear investment strategy are healthcare and/or medicine (35%) and electrification (29%). However, even in these sectors, a significant share of family offices either lack a defined strategy or are unfamiliar with the sector but eager to learn more—48% for healthcare, 57% for electrification.

Generative AI draws particular attention: 19% of family offices already have a clear investment strategy, while nearly two-thirds (64%) are either familiar with the topic but lack a strategy or are unfamiliar but actively seeking information. Family offices believe the biggest beneficiaries of generative AI will be banks/financial services (75%) and the pharmaceutical and biotech sectors (65%).

Notably, family offices invest in these technologies through both public and private markets, choosing whichever path provides access to growth opportunities. For example, 50% invest in healthcare/medicine via public markets, while 47% do so through private markets.

Practical Implications: This information highlights key thematic areas in emerging technologies that are already a focus for many family offices. Offices pursuing growth may consider developing strategies in these sectors, using the levels of interest and familiarity among peers as a benchmark. Understanding which industries are expected to benefit most from generative AI can guide the selection of specific companies or funds. Flexibility between public and private markets allows for the pursuit of optimal opportunities in each case.

6. Risk Management: Global Trade War as the Top Short-Term Risk, Geopolitics and Recession as Long-Term Concerns. The primary investment risk identified by family offices for 2025 is a global trade war (70%). The second most significant short-term risk is a major geopolitical conflict (52%). Looking ahead over a five-year horizon, family offices are most concerned about the consequences of trade tensions: a major geopolitical conflict (61%), a global recession (53%), and a debt crisis (50%).

Finding the right asset or strategy to mitigate risks is a key challenge in portfolio risk management (38%). The most common diversification strategies include manager selection and/or active management (40%), hedge funds (31%), and increasingly, precious metals (19%)—though their overall share in portfolios remains small. One manager noted that they began considering hedge funds and precious metals as diversifiers because bonds and equities no longer move in opposite directions as they once did.

Practical Implications: Understanding the key risks concerning other family offices can help in forming one’s own risk list and assessing preparedness. The difficulty in finding effective diversifiers highlights the importance of this aspect of portfolio management. Family offices may explore the strategies mentioned in the report—active management, hedge funds, and precious metals—and evaluate their applicability to their own portfolios to enhance resilience to market shocks and geopolitical uncertainty.

7. Growing Professionalization and Use of AI in Operational Activities. Family offices are showing a consistent trend toward professionalization by implementing more structured business processes. For example, nearly seven in ten (69%) now have a process for measuring financial performance—an increase compared to previous years. Six in ten (60%) have an annual budgeting process, marking a significant jump from the previous year (up 11%). In the investment sphere, more than six in ten (61%) have an investment committee, which typically includes four family members, three family office employees, and three independent or external members.

Over the next five years, family offices plan to actively leverage AI to boost efficiency and enhance their capabilities. The most likely areas of application include financial reporting/data visualization (69%), text analysis (64%—e.g., summarizing legal documents and financial reports), and quantitative investment analysis/portfolio analysis (62%). Only 6% of family offices do not expect to use AI at all.

Practical Implications: These data offer benchmarks for the level of professionalization and implementation of business processes. Family offices that have not yet adopted practices like financial performance tracking or budgeting can use this information to guide operational improvements. The widespread planned use of AI indicates strong potential for efficiency gains. Family offices can begin exploring how to apply AI in financial reporting, document analysis, and portfolio management to stay aligned with emerging trends and optimize operations.

8. Hiring Priorities: Trust and Personality Matter More Than Qualifications. When making hiring decisions, family offices place a strong emphasis on trust and personality, ranking these qualities above education or formal qualifications. Nearly three-quarters (73%) believe that a candidate must have the right personality for the role, and almost as many (72%) seek someone the family can trust. By contrast, just over half (52%) consider education and/or industry qualifications to be important factors. Cultural fit and trust are seen as critical for long-term success, while competence and experience are viewed merely as "entry requirements."

The first hire in a family office is most commonly an investment portfolio manager (22%), with this figure rising to 29% in offices serving second and subsequent generations. However, regional differences exist. For example, in the U.S., where tax regulation is a key concern, family offices are more likely to hire a legal professional as their first employee (23%).

Despite expected growth in assets under management, family offices continue to operate with relatively lean teams—averaging 12 employees.

Practical Implications: This insight highlights the unique hiring culture within family offices, where personal qualities and trust are paramount due to the close interaction with the family. When planning hires, family offices should assess not only professional skills but also how well a candidate aligns with family values and their ability to build trusted relationships. Understanding typical first hires can help newer offices set priorities when building their teams. Awareness that staff sizes remain small can help manage expectations around operational scale and the potential need for outsourcing.

9. Operating Expenses: Personnel Costs Represent the Largest Share. Net expenses for running a family office (such as personnel, infrastructure, and IT) accounted for the largest portion of operating costs in 2024 and are expected to remain dominant in 2025. In 2024, they represented over half (56%) of total costs on average, with a projected increase to 57% in 2025. Within net expenses, personnel costs make up the overwhelming majority: two-thirds (66%) in 2024, with 67% expected in 2025.

Net expenses in 2024 slightly exceeded expectations—41.1 basis points (bps) of assets under management (AuM), compared to a planned 40.3 bps. Family offices managing more than USD 1 billion benefit from economies of scale, with average costs of 35.1 bps. However, this group also saw the largest overshoot in spending. Expenses also vary depending on whether the family office is associated with an operating business (44.9 bps with a business vs. 33.0 bps without) and which generation is being served (44.0 bps for second and later generations vs. 36.8 bps for the first).

Practical Implications: These figures provide valuable benchmarks for family offices when planning and managing their budgets. Recognizing that personnel is the largest cost component emphasizes the importance of efficient hiring and team management. Family offices can compare their spending—both in absolute terms and as a percentage of AuM—against averages and peer group norms to identify potential areas for cost optimization or confirm the efficiency of their expense structure. Understanding cost drivers such as the presence of an operating business or the generation served is also essential for realistic financial planning.

10. Succession Planning: Low Readiness and Challenges in Engaging the Next Generation. Only slightly more than half (53%) of surveyed family offices have a succession plan for the family’s wealth, leaving a significant number without such a plan despite the risks associated with the founder’s death without a will or inheritance plan. The main reasons for lacking a plan include beneficiary owners not considering it a priority or believing they still have plenty of time (29%), not having made decisions about dividing the estate/assets (21%), or not having found time to discuss it with the family office (18%).

For those families that do have a succession plan, the biggest challenge is ensuring a tax-efficient transfer of wealth (64%). Preparing the next generation for responsible wealth transfer and management is also a significant challenge (43%). Meanwhile, the next generation is often insufficiently involved in the succession planning process from the start: only 26% were engaged from the very beginning. Another 36% were brought in only after consultations with the first generation, and 35% were not involved at all. If younger generations are not consulted, there is a risk that plans will not align with their wishes, which could complicate a smooth transition.

The next generation is expected to play roles in managing the family office: more than half (59%) will take seats on the board of directors and will also be involved in philanthropy (44%), investment management (39%), and strategic asset allocation (41%).

Practical Implications: The low percentage of family offices with ready succession plans is a warning sign. Family offices without a plan need to recognize the urgency of this issue and initiate the process, overcoming the inertia of beneficiary owners. Those with plans can use insights about challenges (tax efficiency, next-generation preparation) to optimize their processes. It is crucial to actively involve the next generation in planning at early stages to ensure goal alignment and a smooth transition. Information about the expected roles of the next generation can assist in their preparation and integration into the family office structure. An example of a Swiss family office with three generations involved and a culture of open discussion demonstrates a successful model of intergenerational collaboration.

Wealth

The Australian Private Capital Yearbook is an annual report that covers data and insights on AUM, fundraising, fund performance, and deals in Australia’s private capital industry, across private equity, venture capital, private credit, and real assets. This report is jointly produced by Preqin, a part of Blackrock, and the Australian Investment Council, the peak body for private capital in Australia. An updated version of the report was published last month.

The Australian private capital market demonstrated resilience and outperformed global counterparts in 2024, affirming its position as a "Calm Port in a Wild Storm". Total Australia-focused private capital Assets Under Management (AUM) reached $139bn as of September 2024, with private equity, venture capital (VC), and private credit funds collectively accounting for $65bn of this amount. Notably, Australia-focused funds vintaged between 2014 and 2021 achieved a median net Internal Rate of Return (IRR) of 13.8%, outperforming other regions, and maintained one of the lowest risk profiles globally with a 15.4% standard deviation of net IRR. The five-year median distributions to paid-in (DPI) ratio for 2019 vintage private equity funds stood at 0.39x, a figure higher than their global private equity peers. Overall dry powder, or unspent capital, decreased by 14% to $39bn by September 2024, suggesting a cautious and selective deployment of capital.

Despite this overall strength, private equity faced a challenging year marked by slowed fundraising and deal activity. The aggregate value of private equity deals in Australia plummeted by 66% to $10bn in 2024 from $30bn in 2023. Conversely, venture capital emerged as a bright spot, bucking global trends with its AUM growing by 7% to $17bn as of September 2024. While overall VC deal value declined, Artificial Intelligence (AI) deals experienced a significant surge, increasing by 49% to $1.3bn in 2024, highlighting a key area of growth. The report also noted the expansion of private credit offerings, with over 51 Australia-focused open-ended private credit funds now tracked, holding a total Net Asset Value (NAV) exceeding $25bn.

A crucial shift in the investor landscape was observed, with family offices now constituting the largest group among active Australian Limited Partners (LPs) by number, representing 40% of private capital investors in 2024, a substantial increase from just 10% in 2020. Despite this growth in family office participation, superannuation funds remain formidable allocators in the private capital market, managing $2.9tn in AUM as of December 2024. The market also adapted through strategies like an increase in corporate carve-outs in private equity deals, with nine such deals in 2024 compared to one or two per year in the prior decade, and significant infrastructure deal activity, including the notable $24bn acquisition of AirTrunk.

For individuals seeking to increase their wealth, understanding the insights from this report is crucial as it highlights the Australian private capital market's exceptional resilience and performance, even amidst global economic headwinds. In summary, the report provides a clear narrative that the Australian private capital market is not just weathering global storms but is outperforming its peers in key metrics like returns and risk management, while also offering increasing accessibility and dynamic opportunities in sectors like AI and private credit. For wealth builders, this translates into a compelling case for allocating capital to this robust and evolving market.

Health

Do you want to live for 20 more years? One particular study keeps getting attention. Forget spreadsheets and complicated protocols. No unreliable vendors or time-consuming routines. Simply effective solutions.

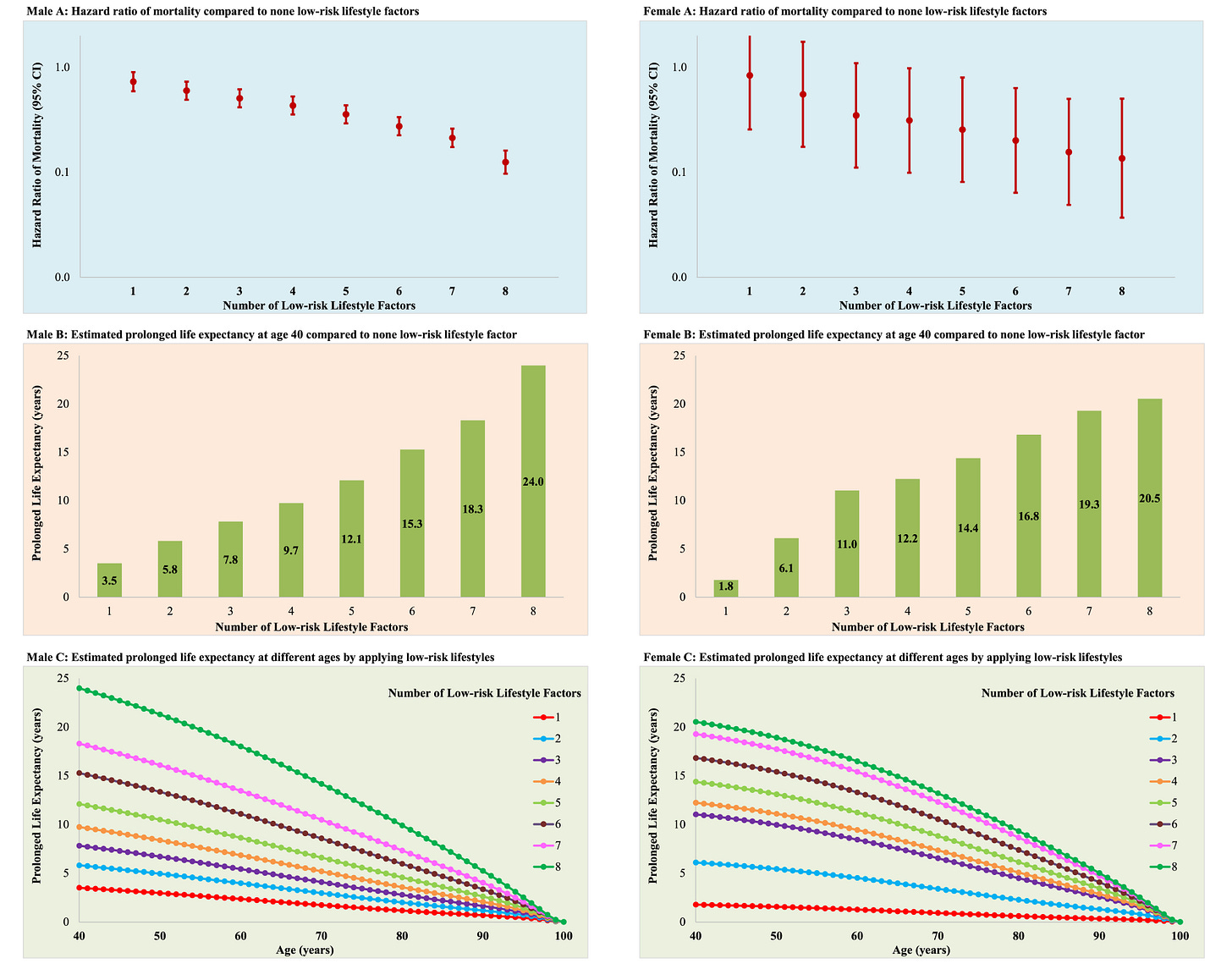

This study involving nearly a million male and female veterans, aged between 40 and 99, from the Department of Veterans Affairs' Million Veteran Program, has identified eight lifestyle factors that significantly increase life expectancy. Data from questionnaires and medical records collected from 2011 to 2019 were analysed by researchers from institutions including Harvard University and the University of Illinois in collaboration with the VA.

The findings suggest that adopting all eight practices could add more than 20 years to one's life expectancy. Specifically, veterans who followed none of the recommended behaviours lived an average of 67 years, while those who adopted all eight lived to approximately 87.5 years. Women who followed all eight practices saw a roughly 21-year increase in lifespan, and men experienced an even greater gain of about 24 years, both calculated from age 40. Another breakdown showed men could gain 23.7 years and women 22.6 years at age 40 when compared to those with no adopted lifestyle factors. Additionally, people adhering to all eight factors saw a 13% reduction in death during the study timeline compared to those who didn't follow any.

The study highlighted eight crucial lifestyle factors for longevity. These include:

Eat well.

Avoid cigarettes.

Get a good night’s sleep.

Be physically active.

Manage stress.

Avoid binge drinking.

Be free from opioid addiction.

Have positive social relationships.

While all eight are important, some practices demonstrated a more substantial impact on mortality risk. A history of smoking, the use of opioids, and insufficient exercise were each linked to a 30% to 45% increase in the risk of an earlier death. Conversely, stress, binge drinking, poor sleep hygiene, and a poor diet were associated with about a 20% higher risk of death during the study period.

It is important to note that individuals don't need to adopt all eight behaviours to see benefits, as even making a few or just one change can prove advantageous. The study also indicates that adopting these habits even after the age of 40 is beneficial, although starting earlier is generally better for overall health.

Enjoying life

In the hushed twilight of Singapore, where concrete dreams stretch skyward, there lies a red velvet sanctuary — The Whiskey Library & Jazz Club. Step inside and the city slips away. Here, time ambles, not rushes. Every chair is a throne, every glass a confession. The room breathes old — world charm: gold — gilded mirrors, low amber light, leopard sculptures crouching near the bar. Jazz murmurs from the corner — not loud, not flashy, just intimate, like a secret whispered in smoke.

Over a thousand bottles gleam on mahogany shelves, each a silent sermon to the art of slowness. You don’t drink here to forget. You drink to remember — lost cities, old loves, the scent of rain on whisky — soaked cobblestones. On Fridays and Saturdays, the music blooms, unrushed and unrepentant. A saxophone croons something between heartbreak and prayer. Glasses clink. Heads nod. The night leans in.

It’s not a bar. It’s a cathedral to the soul’s quieter urgencies. And when you leave, you carry it with you — like the echo of a perfect note, lingering just beyond the noise of the world.

Infographic of the week

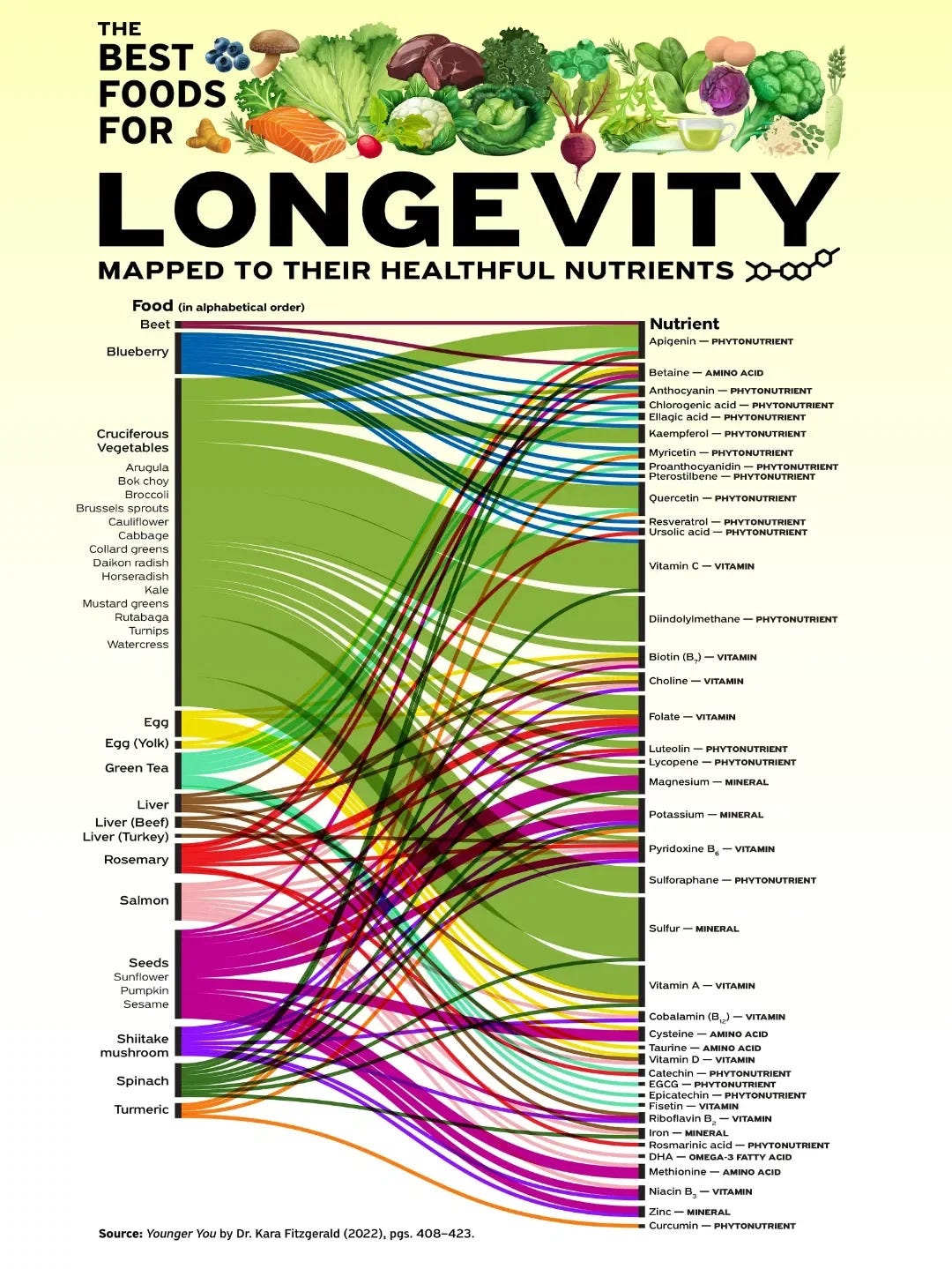

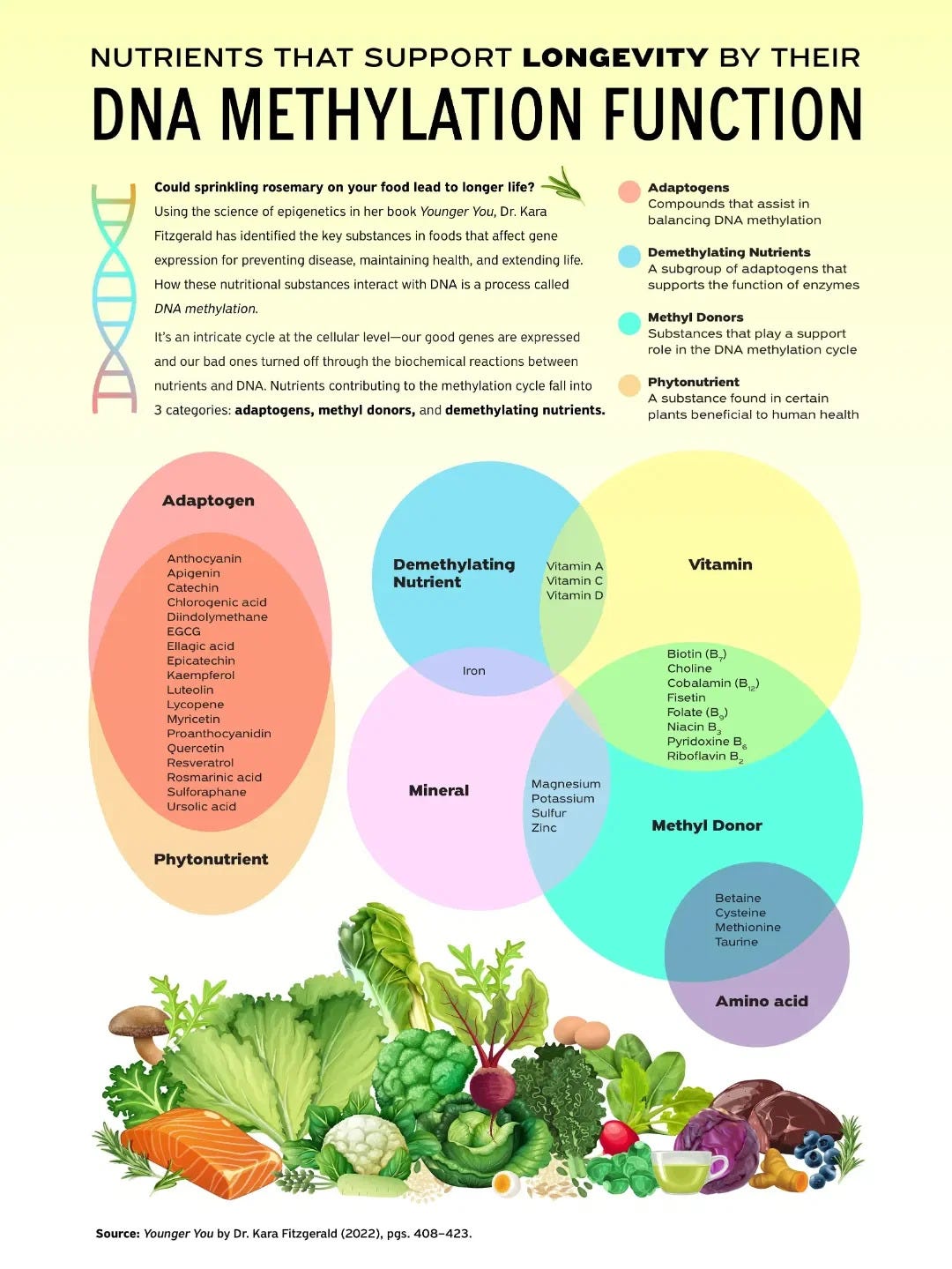

Dr. Kara Fitzgerald's bestseller Younger You identifies 12 superfoods that promote longevity through DNA methylation — a process where beneficial genes activate while harmful ones shut down. Her clinical study showed participants reversed biological age by 3 years in 8 weeks using foods rich in adaptogens, methyl donors, and demethylating nutrients, plus exercise and meditation. The longevity diet emphasizes dark leafy greens, cruciferous vegetables (broccoli, kale, Brussels sprouts, cauliflower, etc.), lean proteins, and adaptogens like turmeric, shiitake mushrooms, and green tea. This whole-foods approach works for both carnivores and vegans. The 12 foods fall into three methylation categories based on how they interact with DNA to prevent disease and extend life. Epigenetics science now explains why traditional whole-foods diets work so effectively for health and longevity when combined with proper supplementation, regular exercise, and meditation practices.

Books of the week

Coming into View: How AI and Other Megatrends Will Shape Your Investments

by Joe Davis

In Coming Into View: How AI and Other Megatrends Will Shape Your Investments, Vanguard’s Global Chief Economist and head of its Investment Strategy Group, Joe Davis, makes a simple and profound argument: that the “status quo” view of the United States economy – one of predictable and relatively constant measures of growth, inflation, and financial returns – is actually deeply unlikely to hold true in the future. The book demonstrates how the promise of artificial intelligence and technological advancement may push against the daunting headwinds of slowing population growth, rising geopolitical tensions and growing national debt, to reshape the economy in ways that conventional thinking overlooks. Davis presents an innovative and original, data-driven framework to consider the probabilities of the coming tug-of-war between AI-fueled growth and inflationary structural fiscal deficits, that can help guide investors as they build investment portfolios to weather uncertain years ahead. A must-read resource for professional and retail investors, Coming Into View is a startlingly insightful and practical guide for anyone seeking to engage with the financial markets as an informed and confident investor.

On Character: Choices That Define a Life

by Stanley McChrystal

How to measure a life? After a career of service, retired four-star general Stanley McChrystal had much to contemplate. He pondered his successes and failures, his beliefs and aspirations, and asked himself, Who am I, really? And more importantly, who have I become? When I die, how will I be measured? In the end, McChrystal came to a conclusion as simple as it was profound: the reality of who we are cannot be recorded in dates or accomplishments. It is found in our character—the most accurate, and last full measure, of who we choose to be. On Character offers McChrystal’s blueprint for living with purpose and integrity, challenging us to examine not just our deeds but who we become through them. Drawing from a lifetime of experience, he distills profound insights on setting and meeting standards, aligning actions with beliefs, and offers practical advice on overcoming obstacles and pursuing self-improvement. According to McChrystal, character is not a trait inherited at birth, nor does it automatically come from education, position, or experience. Character, instead, comes down to a succession of choices, most mundane, several momentous, that reveal the deep truth of our capacity for virtue. In an era where understanding and upholding our ideals is more crucial than ever, On Character offers an inspiring roadmap for personal growth and integrity—a call to become our best selves, both as individuals and as Americans.

Champion Mindset: Coach Yourself to Win at Life

by Patrick Mouratoglou

Superstar coach Patrick Mouratoglou knows what it takes to win. An international icon in the world of tennis, he coached Serena Williams for a decade at the height of her career. Now he currently coaches four-time Grand Slam champion Naomi Osaka and has worked with numerous top players over the years, including Holger Rune, Coco Gauff, Stefanos Tsitsipas, and many more. In Champion Mindset, Mouratoglou distills his lifetime of coaching excellence into ten commandments applicable to achieving success in all aspects of life, not just the court. Mouratoglou’s emphasis on coaching the player’s mindset is what makes him singularly successful as a tennis coach and effective in helping the rest of us reach our goals. He shows us how to embrace the “Progress Zone”—which challenges us and keeps us moving forward. He teaches us how to “Modify Your Inner Language” to turn every moment into an opportunity instead of a place to doubt our intentions. And how to “Take Responsibility for Results”—and really embody it. In addition to being an extraordinary self-help book, Champions Mindset is a gripping personal story in which Coach Patrick reveals his own difficult but rewarding journey. The lessons, insights, and experiences shared in this book are a roadmap to help every reader find their own path to success, however they define it.

Videos of the week

When will AI automate all mental work, and how fast?

Behaviors That Alter Your Genes to Improve Your Health & Performance | Dr. Melissa Ilardo

Essentials: Machines, Creativity & Love | Dr. Lex Fridman

Quote of the week

Property tycoon Patrick Carroll:

“Funnily enough I always thought mental health was for soft-type people to talk about, it was taboo in my opinion. I thought taking medication was weak. I thought ‘Just get over it.’ When I look back to my 30s now, I was hypomanic for a lot of that time, which is where you’re not in full-blown mania but you are operating at a level most people can’t. You are highly-energised, strategic, creative. I think a lot of entrepreneurs deal with it – it’s been speculated Steve Jobs had it and Elon Musk has spoken about how he thinks he is bipolar. I think early on in my career it definitely helped me do things that I probably wouldn't have been able to do without it, for example I would work around the clock. I had non-stop energy, I could connect dots. I feel like I could see around corners and predict things three to five years out in a way a lot of people didn't, and all of those things helped me build my business. My doctor said my brain is like a Ferrari, like a high performance car, but you can’t run it full throttle all the time. I think there are positives with it but left untreated it can blow up your entire life. It can be a blessing and a curse but unmedicated it can get out of control very quickly. I reached out to a lot of business colleagues when I got my formal diagnosis to let them know I had bipolar, and lots of them said ‘We could have told you that.’”

A recent and candid reflection on the intersection of wealth and mental health comes from property tycoon Patrick Carroll. In a June 2025 interview, Carroll opened up about his struggle with bipolar disorder following a severe manic episode in 2024 that culminated in a high-speed police chase and arrest for firing guns from his boat. After selling his management business, personal stressors triggered erratic behavior, including delusions, lavish spending, and paranoia. Diagnosed with bipolar disorder with psychosis during a psychiatric hold, Carroll initially ignored treatment but later voluntarily admitted himself to McLean Hospital. Carroll’s public episode led to legal troubles, including dropped criminal charges and settled civil lawsuits. He expressed frustration that some individuals attempted to profit from his illness. Now an advocate for mental health awareness, Carroll emphasizes the importance of treatment and seeks to use his platform to educate others and support mental health initiatives. He acknowledges past misconceptions about mental illness and highlights the hidden struggles many face, regardless of outward success. This narrative underscores the profound connection between financial success and mental health, illustrating that wealth does not immunize individuals from psychological struggles.