Dispatch #21

Wellness Real Estate, Big Bucks. Wealth Management's Growth Crisis. The Uncomfortable Truth of Wealth and Health. Luxury Takes to the Nile. Mapping Global Riches

Dispatch #21 explores how the built environment increasingly influences human health and well-being, highlighting the burgeoning "wellness real estate" market. It reveals a significant shift in wealth management, where organic growth, driven by attracting and retaining clients, is now crucial for financial firms, moving beyond reliance on external market factors. The report also delves into the complex relationship between regional wealth and health outcomes, particularly concerning noncommunicable diseases, and presents a stark comparison of life expectancies between wealthy Americans and Europeans, suggesting systemic issues affect US health regardless of affluence. Finally, it touches on luxury travel trends and wealth distribution in major cities, alongside a curated list of books and videos offering diverse perspectives on success and finance.

Main topic of the week

Making money on wellness real estate

The Global Wellness Institute (GWI) recently released a significant report, Build Well to Live Well: The Future, which delves into the burgeoning concept of "wellness real estate," updating their original 2018 report on the subject.

This report underscores a critical insight: a substantial 80-90% of our disease risks, health outcomes, and life expectancy are shaped by modifiable environmental and lifestyle factors, rather than merely our genetics. Epigenetic research further supports this, indicating that our surroundings and life experiences can alter gene expression, influencing disease risk and even intergenerational health. The GWI report meticulously illustrates how our built environments can be purposefully designed to enhance physical, mental, social, financial, ecological, and civic well-being.

The central idea is that investments in real estate should fundamentally be investments in well-being. Considering that nearly 15% of global GDP, over USD 16.5 trillion in 2024, is spent annually on construction shaping our living and working spaces, and housing itself represents about 20% of global consumer spending, or USD 12 trillion in 2024, it logically follows that what we construct should contribute to our health.

The concept of wellness real estate appeals to several key groups.

Consumers and residents have shown considerable interest, particularly after the COVID-19 pandemic heightened their awareness of the importance of clean air, access to nature, social connections, stress management, and quality sleep, all influenced by their environment. They are actively seeking healthy places to live, raise families, and age gracefully with extended healthy lifespans.

For investors, understanding the direction of this market is crucial; with growing demand for health, sustainability, and quality of life, investments in wellness properties are not only becoming profitable but also sustainable in the long term. People are increasingly choosing homes that offer comfort, safety, proximity to nature, reduced illness, and an overall improved sense of well-being, fundamentally altering real estate market dynamics.

Developers and architects see this as an opportunity to differentiate themselves by creating projects that genuinely address contemporary human challenges, from stress and isolation to sedentary lifestyles. Wellness is emerging as a new standard, where the business of building shifts from merely constructing square metres to offering an entire lifestyle, which holds significantly greater value for buyers. Such properties are easier to sell, retain their value better, and attract a loyal audience more quickly.

Lastly, for brands and services, it signals a shift in consumer priorities from just where people live to how they live. Businesses can integrate into the ecosystem of these wellness-centric residential complexes, offering products and services related to health, nutrition, mental well-being, activities, and smart home technologies – ranging from yoga studios and air purification systems to sleep apps and healthy eating cafes. This environment becomes a new platform for client engagement.

The economic benefits of wellness real estate are significant and diverse. Developers and owners observe consumers' readiness to pay a premium for properties that enhance health and well-being. Residential properties can command a price premium of 10% to 25%, while commercial buildings can achieve a rental premium of 4.4% to 7.7% per square foot. Profitability in this sector extends beyond price premiums to include other substantial economic advantages, such as faster sales and absorption rates, longer waiting lists, reduced tenant and employee turnover, increased lease durations, and consequently, higher resident and tenant satisfaction. In commercial real estate, investments in wellness features translate to increased employee productivity and efficiency, reduced absenteeism and presenteeism, and improved talent attraction and retention metrics.

Moreover, companies are increasingly incorporating health and well-being into their ESG (Environmental, Social, and Governance) strategies, which attracts socially responsible investments. Ultimately, profitability in this sector can be achieved through direct investments in construction and sales, as well as through the provision of services and products that form part of the wellness experience. This signifies a move beyond just real estate to an entire lifestyle that an increasing number of people are willing to embrace and pay for.

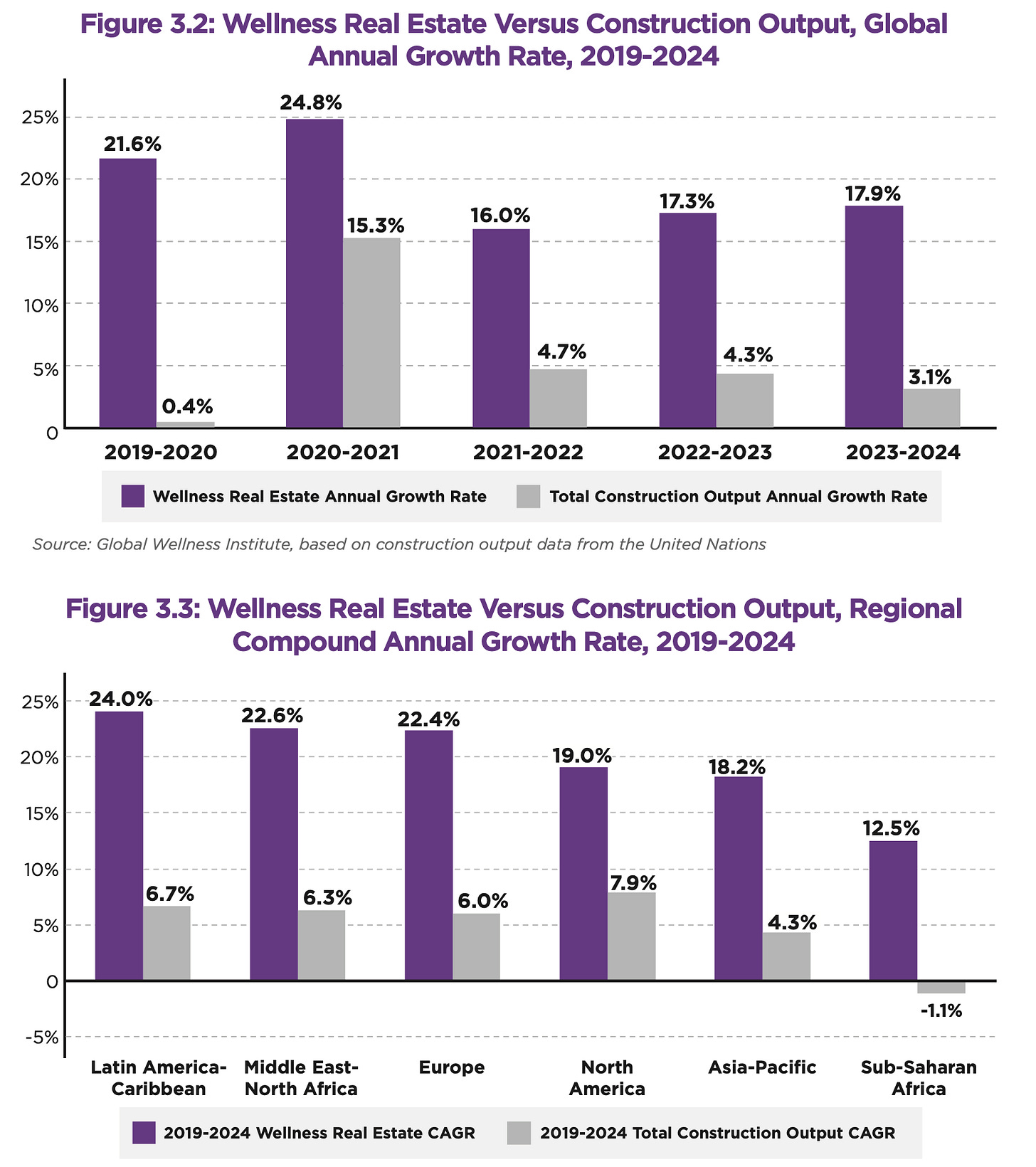

The global market for wellness real estate is experiencing rapid growth. The GWI estimates that the market reached USD 548.4 billion in 2024, marking a 17.9% increase from 2023. Currently, wellness real estate accounts for approximately 3.3% of the total annual global construction volume. Over the five-year period from 2019 to 2024, the wellness real estate market grew at an average annual rate of 19.5%, significantly outperforming the general construction sector's average annual growth of 5.5%. Projections indicate that this robust growth will continue, with an anticipated average annual growth rate of 15.2% over the next five years, pushing the market to USD 1,114.0 billion by 2029.

Geographically, the wellness real estate market is highly concentrated, with North America, the Asia-Pacific region, and Europe together comprising 99% of the global market. In 2024, North America remained the largest regional market, accounting for 44% of the total global volume. Notably, wellness real estate growth rates surpassed overall construction growth by two to four times or more in every region between 2019 and 2024.

The fastest-growing regional markets for wellness real estate during this period were Latin America and the Caribbean (24.0% Compound Annual Growth Rate - CAGR), the Middle East and North Africa (22.6% CAGR), and Europe (22.4% CAGR).

Growth in Latin America and the Caribbean was largely driven by robust overall construction activity in Mexico, Brazil, and Argentina until 2023.

In the Middle East and North Africa, most of the growth is concentrated in the United Arab Emirates and Saudi Arabia.

Europe has seen significant wellness real estate expansion in the United Kingdom, France, Germany, Netherlands, Italy, and Sweden.

Key and rapidly growing countries in the Asia-Pacific region include China, Australia, Japan, India, and South Korea.

The leading countries by market volume in 2024 were: the USA at USD 223.17 billion (representing 41% of the global market), followed by China (USD 86.29 billion), the UK (USD 38.50 billion), Australia (USD 30.86 billion), France (USD 28.53 billion), Japan (USD 21.45 billion), Germany (USD 18.58 billion), Canada (USD 16.27 billion), India (USD 12.63 billion), and South Korea (USD 11.85 billion).

The proliferation of wellness building certifications highlights the sector's increasing formalisation and demand for verifiable standards. The number of projects certified by WELL and Fitwel standards increased almost fiftyfold from 2017 to 2024, reaching over 4,550 certified projects globally by the end of 2024. Of these, over 53% are located in the United States. While most certifications apply to office/commercial and mixed-use properties, approximately 24% are residential projects, including multi-family, single-family homes, and senior living facilities. As of May 2025, an additional 2,000 projects were in the process of certification (Fitwel) or pre-certification (WELL) across 49 countries, predominantly in the USA, China, the UK, and India.

Other certifications such as Living Building (with over 250 certified projects) and UL Verified Healthy Buildings (895 globally) also exist. Furthermore, established "green" building certifications like BREEAM (over 610,000 buildings), LEED (over 118,300 projects), and Passive House (over 47,400 projects) are increasingly shifting their focus to incorporate human health and social sustainability.

The GWI report outlines six key principles to guide developers and builders towards a holistic approach to health and well-being throughout the development process. These encompass scalability (from a single home to an entire neighbourhood), intentional and multidimensional integration of wellness, a shift from a "do no harm" philosophy to actively optimising well-being, stimulating active lifestyles, embedding wellness into infrastructure and operations, and transitioning from individual to community well-being. This integrated approach moves beyond merely a collection of expensive amenities, prioritising health and well-being as the foundation of planning, applicable to both individual homes and large-scale residential complexes, and not necessarily linked to high costs.

Looking ahead, the report identifies 12 key ideas that will shape the future of wellness-oriented real estate, focusing on unmet needs and opportunities for innovation. These include adaptation to climate change and resilience, fostering environmentally clean and sustainable living environments, innovations to improve the construction process and housing provision, ensuring healthy housing for lower-income segments, wellness-oriented urban regeneration, evolving from healthcare clusters to healthy communities, supporting increased healthy longevity and thriving in old age, diversifying co-living models, creating healthier food environments, leveraging the benefits of nature, improving the sensory environment through neuroarchitecture and art, and integrating well-being into travel and tourism infrastructure.

This evolving landscape demonstrates a shift towards designing built environments that actively contribute to a healthier, more harmonious life in response to contemporary challenges related to lifestyle, ecology, and social isolation.

Wealth and Health

The Boston Consulting Group recently released its Global Wealth Report 2025, which looks at how the global wealth management industry is changing. The report reveals several critical conclusions about the state and future direction of global wealth management:

The sources of wealth growth are shifting, making organic growth indispensable for long-term value creation. While global financial wealth reached an all-time high of $305 trillion in 2024, growing over 8% due to strong equity markets and positive investor sentiment, and total net wealth grew by 4.4% to $512 trillion, the underlying dynamics are profound. A crucial insight is that less than a third of assets under management (AuM) growth over the past decade was generated organically by existing advisors, with this figure dropping to just 22% in mature markets. Net new asset (NNA) performance has become a highly reliable indicator of valuation multiples for wealth managers, explaining roughly half the variation in price-to-earnings (P/E) multiples across the industry. This underscores that the ability to grow by attracting and retaining client assets is now seen as the single most important driver of long-term value creation.

Wealth managers have significantly struggled with organic growth, relying heavily on external factors rather than internal capabilities for AuM expansion. Over the last decade, only about 28% of total AuM growth globally was truly organic, generated by advisors already employed at the firm and excluding market performance, currency effects, M&A, and assets brought in by newly hired advisors. Instead, firms largely benefited from three external tailwinds: capital markets appreciation (accounting for about half of AuM growth in North America), M&A (contributing roughly 10% to the AuM base for large players), and advisor hiring (effectively buying growth from competitors by onboarding their existing client books). This struggle is rooted in structural issues, including advisors being less focused on new client acquisition, the rising administrative burdens from compliance, and new competitors gaining market share.

There are notable regional disparities in financial wealth creation and organic growth performance across the globe. In 2024, North America was the strongest engine of financial wealth creation, expanding by 14.9%, primarily driven by a 23% rise in the S&P 500. Asia-Pacific followed with 7.3% growth, while Western Europe lagged at 0.8%. Looking ahead to 2029, Asia-Pacific is forecast to lead global financial wealth expansion, with projected growth of approximately 9% annually, significantly outpacing North America (4%) and Western Europe (5%). From 2014 to 2024, wealth managers in Latin America (LATAM) and Asia-Pacific (APAC) achieved much higher organic growth rates of 52% and 50% respectively, more than double that of their peers in EMEA and North America (both around 22%). These differences are fundamentally linked to growing investable wealth and new millionaire populations in emerging economies, enabling advisors to bring in new clients and assets.

Universal banks hold inherent structural advantages for achieving organic growth compared to pure-play wealth managers. While pure-play wealth managers appeared to grow faster in overall AuM over the last decade (nearly 8% annually versus 7% for universal banks), only 15% of pure-plays' growth stemmed from net new assets generated by existing advisors, compared to 32% for universal banks. Universal banks benefit from consistent internal referrals from corporate and investment banking arms, easier conversion of mass affluent retail clients to wealth relationships, greater capital strength allowing for customized lending, and stronger brand recognition. This built-in advantage, if properly leveraged through cross-divisional collaboration and structured incentive frameworks, can lead to best-in-class NNA performance and significant cross-selling.

The path to sustainable organic growth requires strategic investment in internal capabilities, particularly leveraging advanced technology and focused engagement models. The report emphasizes that top-performing firms are investing in key capabilities like a clearer market presence, more deliberate client acquisition, better-equipped advisors, and earlier, more relevant engagement with rising generations, with technology playing a central role in scaling these capabilities. Specific high-impact levers include enhancing trust and differentiation through brand building, utilising GenAI for more systematic lead generation and digital marketing (which has helped early movers generate 5x more leads and double conversion rates), implementing data-driven product distribution and lead management systems (leading to up to 15% higher product revenue and 20% churn reduction), and engaging the next generation of clients with tailored, technology-enabled experiences that can speed onboarding by 30% to 40%.

What are the overall insights from the report on what wealth managers need to do to genuinely foster organic growth? The pragmatic advice boils down to proactive, technology-driven strategies focused on attracting, retaining, and deepening relationships with clients by empowering advisors and leveraging internal capabilities, rather than passively relying on market upswings or simply acquiring existing client books through M&A or advisor hiring.

No evidence of a "true negative effect of wealth"

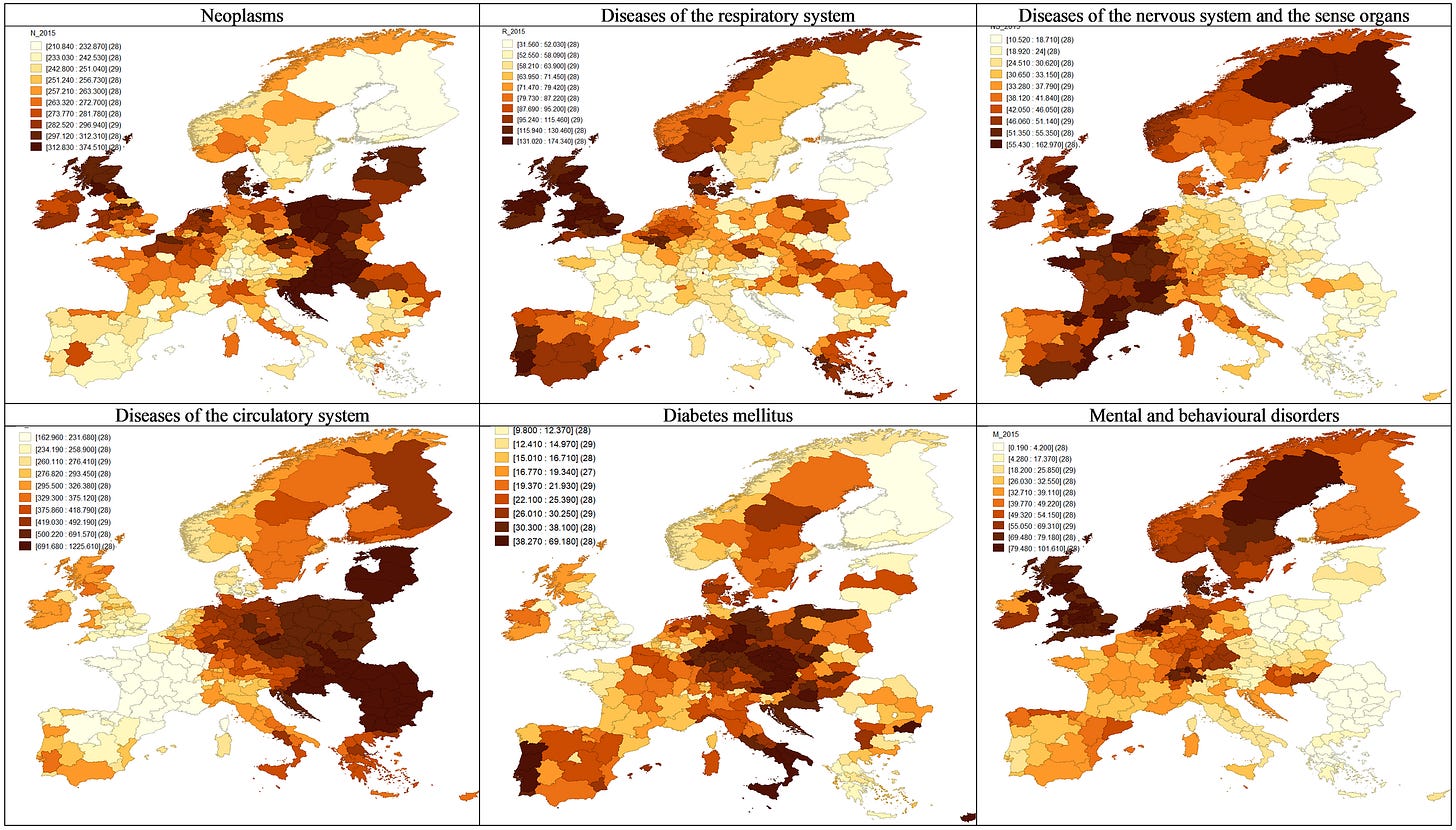

The report, "The net effect of wealth on health — Investigating noncommunicable diseases mortality in the context of regional affluence," examines the complicated and changing link between how wealthy a region is and the number of deaths from noncommunicable diseases (NCDs) in Europe. It highlights that more money can introduce new health risks, but also leads to better healthcare and greater awareness, which can lower disease rates or improve treatment outcomes. The main goal of the study was to work out this "net effect" of wealth, which is the overall impact of prosperity, and to pinpoint a "health economic threshold" – a specific level of wealth where the way prosperity affects health noticeably shifts.

In theory more money or increased affluence can introduce new health risks because socioeconomic development and modern life often bring a range of detrimental influences and new risk factors. It can be permanent mental strain or ubiquitous stress, which is often inherent in modern lifestyles associated with greater wealth. It can be harmful eating habits and sedentary lifestyles that become more prevalent in affluent societies. It can be exposure to artificial light and irregular sleeping patterns, which are also by-products of contemporary living. These factors collectively increase the probability of noncommunicable diseases (NCDs), such as mental and neurological disorders, diabetes, cancer, and cardiovascular and respiratory illnesses, impacting a population.

A key finding is that for most NCDs studied, this health economic threshold generally sits around 20,000 euros per person, though for cancers (neoplasms), it's much higher, around 37,000 euros. The research clearly showed that in less wealthy regions, deaths tend to increase as prosperity grows. However, once regions cross this threshold, the trend either stabilises or even reverses. Importantly, the study found no evidence of a "true negative effect of wealth," meaning that death rates don't just keep rising indefinitely with more money in already rich areas, which suggests that good healthcare systems and prevention efforts play a crucial role in limiting these negative health impacts.

Different diseases show different patterns. For cardiovascular diseases and cancers, mortality drops as wealth increases in poorer areas, then flattens out once the threshold is met. This means more money has a positive overall effect up to a certain point, but further reductions in deaths become very difficult beyond this level, perhaps due to factors like lifestyle choices. For diabetes, the pattern is consistently decreasing mortality with increasing wealth across all regions beyond its relatively low threshold (around 17,000 euros). This positive effect of wealth for diabetes appears to have no limit, likely because diagnostics and treatments are more accessible and affordable.

In sharp contrast, mental and behavioural disorders and diseases of the nervous system show a harmful overall impact of wealth on health. In less affluent regions, higher GDP actually correlates with increased death rates. While mortality stabilises in wealthier regions after crossing their threshold (around 22,000 euros), there's no sign of the trend reversing.

In conclusion, the report strongly argues that health policy needs to be more varied and tailored to local conditions to achieve better health outcomes across Europe. Furthermore, it makes a significant recommendation: health policy must prioritise mental and neurological disorders, dedicating more resources and raising public awareness. This is crucial because for these conditions, there's no evidence that increased wealth alone leads to improved mortality, highlighting the need to actively counter the hazardous side effects of prosperity.

America's wealthiest citizens have lower life expectancy than Europe's affluent populations

A groundbreaking study published in the New England Journal of Medicine by Brown University researchers reveals a troubling reality about American health outcomes. The comprehensive analysis examined over 73,000 adults aged 50-85 across the United States and various European regions to investigate how wealth influences mortality rates.

The research uncovered that Americans at every economic level face higher death rates than their European counterparts over a 10-year period. Most strikingly, America's wealthiest individuals experience shorter lifespans than Europe's richest residents, with some wealthy Americans having survival rates comparable to the poorest Europeans in Western nations like Germany, France, and the Netherlands.

Within the United States, the wealth-mortality divide is particularly pronounced. The study found that individuals in the highest wealth quartile had 40% lower death rates compared to those in the poorest quartile. However, when compared internationally, Continental Europeans died at rates approximately 40% lower than Americans, Southern Europeans at 30% lower rates, and Eastern Europeans at 13-20% lower rates.

The researchers attribute these disparities to systemic issues affecting all Americans, regardless of wealth status. Weaker social safety nets, structural inequalities, and cultural factors such as dietary patterns, smoking prevalence, and rural living conditions contribute to poorer health outcomes. The study also identified a "survivor effect" where early deaths among the poorest Americans create a misleading impression that wealth inequality decreases with age.

Lead researcher Irene Papanicolas emphasized that even America's wealthiest citizens cannot escape the country's systemic health challenges, including economic inequality, stress, diet-related issues, and environmental hazards. The findings suggest that improving American health outcomes requires addressing broader societal factors beyond healthcare system reforms, with other nations providing potential models for more effective approaches.

Enjoying life

The Waldorf Astoria, Hilton's premier luxury brand, is set to introduce an all-suite cruise ship on the Nile River, with voyages commencing in late 2026. This new offering, dubbed the Waldorf Astoria Nile River Experience, aims to provide travellers with an opulent means of exploring the world’s longest river. Announced on June 24, 2025, the itineraries will range from four to six nights, focusing on Egypt’s most iconic landmarks. Guests can choose routes either downriver from Luxor to Aswan or upriver from Aswan to Luxor, benefiting from private docks in both locations. The journeys are designed to immerse guests in Egypt’s rich history, with planned stops at the historic temples in the Valley of the Kings, as well as various cultural attractions in Esna, Edfu, and Kom Ombo.

While the specific vessel remains undisclosed, the ship will feature five decks and 29 suites, promising a comprehensive array of hotel-like amenities. Onboard facilities will include a high-tech fitness centre, a lavish spa, and a relaxing rooftop deck. Culinary delights will be served at the Waldorf Astoria’s signature Peacock Alley, offering refined dishes, alongside a brasserie featuring Egyptian, Mediterranean, and international cuisine. Guests can anticipate the finest Waldorf Astoria service throughout their stay, supported by the convenience of personal concierges available at their whim. Dino Michael, Senior Vice President and Global Head of Hilton Luxury Brands, expressed his anticipation for this unique experience.

This expansion into luxury cruising is a strategic move for Hilton, capitalising on the burgeoning tourism in Egypt, which saw a 25 per cent increase in the first quarter of 2025, welcoming 3.9 million tourists. Hilton currently operates 14 hotels in Egypt and plans to significantly expand its footprint by opening 35 more. The Waldorf Astoria brand itself has 34 locations worldwide, including a 589-room hotel that opened in Cairo in 2023. Although there are existing high-end Nile cruise operators like Viking and Ama Waterways, and options for luxury yacht charters, Waldorf Astoria is entering the cruising market relatively late compared to other luxury brands such as Ritz-Carlton, Belmond, Aman, and Four Seasons, who have already launched or are planning their own cruise liners. Nevertheless, this addition is expected to foster healthy competition and potentially elevate the overall standard of luxury river cruises.

Infographic of the week

Mapping the World's Wealthiest Cities

Henley & Partners collaborates with wealth intelligence firm New World Wealth to produce an annual World's Wealthiest Cities Report, serving as the authoritative resource on urban wealth distribution. This comprehensive analysis examines the globe's 50 most affluent cities while offering expert analysis of economic mobility trends, luxury real estate markets, investment migration patterns, and wealth management practices. The report also evaluates wealth concentrations across more than 100 locations where centi-millionaires cluster globally.

New York City leads with nearly 400,000 millionaire residents, leveraging its position as an international financial center. The Bay Area ranks second and represents one of the world's most rapidly expanding wealth hubs. Tokyo secures third place, drawing affluent individuals through its exceptional living standards and corporate giants such as Sony.

Books of the week

A Trick of the Mind: How the Brain Invents Your Reality

by Daniel Yon

How does your brain decide what it's seeing, from the physical world to other people? For decades, scientists have tried to understand how our brains work, not realizing that the answer lies much closer to home. New research in neuroscience and psychology suggests that the brain is doing the same thing that the scientists are: using past experiences to build theories of how the world works, and using these models to predict and make sense of it. Through this process, your brain constructs the reality that you live in. Daniel Yon takes the research one step further, uncovering how your brain colors your perception of the world, the judgements you make about other people, and the beliefs you form about yourself. These mental processes help us navigate the world—but can also lead us astray, causing us to believe outlandish conspiracy theories or to see things that aren’t really there. By understanding the ways each of our brains construct our realities, we can better engage with other communities and make more informed approaches about mental illness. With cutting-edge research and transformative practical applications, A Trick of the Mind will revolutionize the way you think.

Against Identity: The Wisdom of Escaping the Self

by Alexander Douglas

Modern life encourages us to pursue the perfect identity. Whether we aspire to become the best lawyer or charity worker, life partner or celebrity influencer, we emulate exemplars that exist in the world – hoping it will bring us happiness. But this often leads to a complex game of envy and pride. We achieve these identities but want others to imitate us. We disagree with those whose identities contradict ours – leading to polarization and even violence. And yet when they thump against us, we are ashamed to ring hollow. In Against Identity, philosopher Alexander Douglas seeks an alternative wisdom. Searching the work of three thinkers – ancient Chinese philosopher Zhuangzi, Dutch Enlightenment thinker Benedict de Spinoza, and 20th Century French theorist René Girard – he explores how identity can be a spiritual violence that leads us away from truth. Through their worlds and radically different cultures, we discover how, at moments of historical rupture, our hunger for being grows: and yet, it is exactly these times when we should make peace with our indeterminacy and discover the freedom of escaping our selves.

Rule 62: Meditations on Success and Spirituality

by Jared Dillian

Forget the couch and the TV and say goodbye to punching the clock. Rule 62 is a wake-up call and manifesto for living life to the fullest: he who makes the most memories wins. It's time to get out of bed every morning like the Raiders of the Lost Ark theme song is playing on your alarm. Equal parts raucous and soulful, essayist Jared Dillian shines a provocative light on some of the deepest questions humans have asked. What does it mean to live a life full of meaning? How does love really work? What is genuine wealth—and how should you acquire and use it? How do you avoid regrets? How do you respond to betrayal, trauma, or illness? Over the course of 79 introspective and often hilarious essays, drawing deeply on his own experiences with setbacks and success, Dillian shares surprising and thought-provoking answers to all these and more. Like: discovering the importance of saying yes to things. Why character matters as much as smarts. The counterintuitive way to let go of resentments. Why hating other people's success condemns you to mediocrity. The power of just doing the thing already. The importance of being worthy of compliments. Why the unplanned is better than the planned. How living in the present brings peak performance. Why dying is one of the most important things we will ever do.

How to Invest in Oil: Stories, Insights, & Strategic Recommendations from an Oil Entrepreneur

by Rich Tabaka

Oil and gas investing has long been a pathway to wealth for those in the know. In How to Invest in Oil, Rich Tabaka reveals how this often-overlooked sector can deliver financial freedom, tax advantages, and portfolio diversification. Drawing from years of experience as an oil entrepreneur, Tabaka shares a no-nonsense guide to navigating the opportunities and challenges of this high-stakes industry. Through engaging stories and straightforward insights, Tabaka explains the technical aspects of drilling, the financial nuances of tax-advantaged investments, and the red flags every investor should watch for. Learn how he turned setbacks—like a $750,000 loss—into the foundation of Allied Resource Partners, a Kansas-based success story. Whether you’re interested in the allure of passive income energy or the science of Kansas oil fields, Tabaka’s advice is actionable and clear. Packed with tools for high-net-worth individuals and their advisors, this book covers everything from assessing exploration opportunities to understanding vertical vs. horizontal drilling. How to Invest in Oil is a must-read for anyone ready to tap into one of the most lucrative sectors in alternative investments.

The Bottomless Cup: A Memoir of Secrets, Restaurants, and Forgiveness

by Kevin Boehm

James Beard Award–winning restaurateur Kevin Boehm has opened 40 restaurants in his 30-year career. He’s worked with hard-core line cooks and celebrity chefs, suffered embarrassing setbacks, and won Michelin stars. Today his Boka Group is one of the most successful restaurant companies in the world. But Boehm’s path was a complicated one. A turbulent family life and a shocking revelation about his father drove him out into the world in search of a home. He found one in restaurants. Amidst other gifted and damaged people, he discovered the magic of hospitality and the thrill of a dining room on the edge of chaos. The Bottomless Cup is Boehm’s vibrant, funny and frank account of a life in and out of restaurants. This is a memoir about dropping out and finding your place, about opening nights and what comes after, about chefs, partners, guests, and critics. The Bottomless Cup is a story of ambition and adrenaline, of reaching remarkable highs and reckoning with the costs.

Videos of the week

Karthik Ramanna on “The Age of Outrage” | McKinsey Author Talks

The Millionaire Map: How Real Estate Creates Wealth

Scott Galloway on Reaching His Number & Refusing To Chase Billions

Passive Investing Is Breaking the Market — Here’s the Hidden Cost (Rob Arnott & Cam Harvey)

Quote of the week

“Being rich is a good thing. Not just in the obvious sense of benefiting you and your family, but in the broader sense. Profits are not a zero sum game. The more you make, the more of a financial impact you can have. don’t care what anyone says. Being rich is a good thing.Go out there and get rich. Get so obnoxiously rich that when that tax bill comes, your first thought will be to choke on how big a check you have to write.”